Okay, so maybe this is more of a rant than a blog...but still, I feel that this is a treachery! How quickly this country forgets the ideas that it was founded on. Although in this case, I feel it is not forgetfulness, or even hypocrisy, but actual treachery! I'll explain...

As most of you may or may not know, Angelica and I are at odds with the ways of this country. Unfortunately, this is with most of the things this country does, at least the main and probably most important ones in our view. We disagree with its approach to health care, which to make things short should be a human right, not based on insurance, employment, money, pre-existing conditions, but on your health-care needs. <---Period. Of course I don't feel comfortable in a system that devotes such a huge part of its national budget to "defense" which is actually more like "attack". The educational system in this country is a joke(not a very funny one). So is its environmental policy(this one is also not funny). Separation of church and state is headed backwards instead of towards a true separation. This country places corporations before people. I can go on and on....the point is, that unlike most people that just talk and talk, we actually wanted to do something about it. GET OUT! Yes, we want to move out of this country. You hear people say "If you don't like it, get out!". And that is exactly what we want to do. Except, here is what is really treacherous. And I quote from the IRS.gov website:

"If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. Your worldwide income is subject to U.S. income tax, regardless of where you reside."

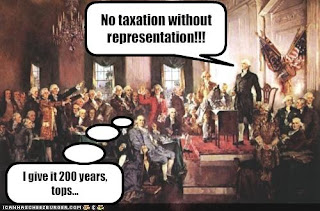

I don't know if you follow the treachery of what this means. But it is saying that even if I live in ANY other country, and work for a foreign company, the US still taxes me just because I am or was at one point a US citizen! What???!!! This country went up in arms because of this very same principle! The United States fought England because they were being taxed, but not represented! No taxation without representation!! There was a revolution in this country over this!!! That was one of the slogans!! Did they forget this already? How is this any different? If I am living in Mexico, France, Costa Rica, Canada, the moon, doesn't matter. The US is no longer representing me, so why are they taxing me?!?!?!?!?!?!?! And get this, it is illegal to denounce your US citizenship for tax reasons. what?! Is hating most of what this country stands for a valid reason? And yet another catch. Even after you denounce your citizenship, you are still responsible for paying the US taxes for 10 years!!! And of course the US has income tax treaties with over 42 other countries. Now, both the IRS and the foreign taxing authorities can exchange information on their citizens living in the other country. What this means is that if I choose not to pay the US taxes when I move away, the local authorities may choose to arrest me for "tax evasion" and turn me over to the US...

Can anyone explain to me how it is fair to tax someone you don't provide anything to?! "If you don't like it, get out of this country!" doesn't really work when you can't get out of this country unless you want to pay double taxes! This is really upsetting...why does the US get away with anything it wants?! Why is it so hypocritical? Or is this seriously just ill intentioned? How does it seem acceptable to violate the very same principles you take so much pride of being founded upon? And what can be done about this? Can laws that screw the few people that are leaving this country even get the necessary legal push behind them to be changed? This affects no one that plans to stay in this country...which is like 99.999% of people in this country. This country won't even change a healthcare system that is hurting millions, how can this possibly get any attention?! This really makes me consider becoming a "rebel" and living under the radar of the US. I utterly refuse to pay the US taxes when I am no longer here. Why should I?! If anyone can please rationally explain why it is my duty to do so, please do! I am trying to make sense of this, but I can only conclude that this is a treacherous country...and I truly wish I was not part of it.

I completely agree with you. It is ridiculous!! and upsetting! As if moving to another country wasn't hard enough...

ReplyDeleteI'm sure they would argue that it is done so you don't abuse the system if you choose to go back to the US after not paying taxes for your stay abroad.... But give me a paper saying that I give up my social security benefits/medicare and so on, and I'll sign it... just LET ME OUT!!

ok I'll play devil's advocate

ReplyDelete1) That Law is not actually meant for disgruntled Americans. I'm pretty sure it is in place to try and prevent the very rich from dodging taxes. If you earn up to $91,500 you are eligible for the Foreign Earned Income Exception and won't have to pay taxes to the US.

2) Taxation without representation was a slogan in reference to a lack of direct representation of the colonies. When an American lives abroad he/she is encouraged to be represented via absentee ballots which count as much as a regular domestic ballot.

Many U.S. policies are very flawed, the healthcare system is a mess, and the student loan problem is HUGE and nobody cares. So dont think i'm drinking the Kool-Aid.

Wow, I'd never imagine something like that, but that is pretty messed up, and makes absolutely no sense. I agree with you, but yeah, I bet it's even worse living in Mexico... well, because of Mexico's approach to... everything, but yeah, haha

ReplyDeleteare you serious????? this must be a mistake?? dude, this is ridiculous! so we're pretty much screwed just because we're us citizens???? wtf!!

ReplyDelete